https://seekingalpha.com/article/4736015-take-a-cold-bite-of-americold-realty-trust

Nov. 11, 2024 11:45 AM ETAmericold Realty Trust, Inc. (COLD) StockCOLD

1.44K Followers

- 5Share

- Save

- Play(10min)

- Comments(6)

Summary

- Americold Realty Trust, the largest tradeable cold-storage REIT, has underperformed due to management miscalculations and excess capacity.

- I like the cold-storage industry long-term, and furthermore wonder whether incoming Trump Administration policies could cause a business inflection.

- Americold’s leadership team is relatively new, and might be on a short leash to improve results or be replaced.

- I’m comfortable taking a full position in COLD below $23, collecting a ~4% yield as I wait for operational improvements.

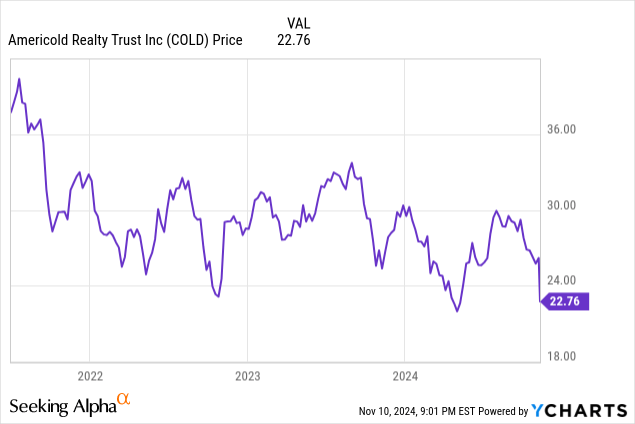

I’ve long monitored Americold Realty Trust (NYSE:COLD) but historically hesitated to make a full allocation within my portfolio. I’ve held small positions from time to time, but my interest has grown more substantially following the recent share price decline after the company’s Q3 2024 report. This is an underperforming business, but that’s often when I like to pick up shares.

Americold’s roots go as far as the early 1900s, when the idea of cold storage services for the food industry grew into serious business. Americold is the 2nd largest cold storage company in North America, and also the 2nd largest in the world. It does have international operations, but more than 80% of the company’s business takes place in North America. Industry leader Lineage (Logistics) Inc is privately held, as is #3 firm U.S. Cold Storage Inc, leaving Americold has the only way to gain meaningful exposure to the industry.

Understanding The Business

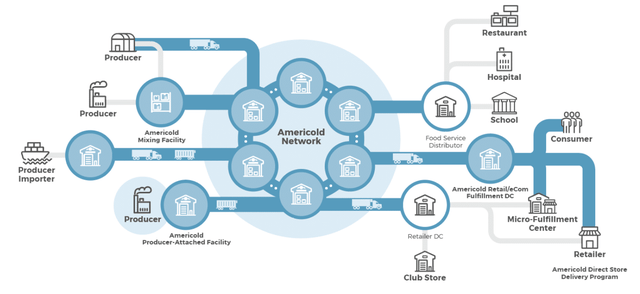

Understanding Americold’s operations isn’t rocket science. Chilled or needs-to-be-chilled products enter the company’s network from various sources, potentially from local or national producers, or through import activities. The goods then sit in Americold’s possession until they are distributed towards end customers.

The majority of what Americold does is warehousing – temperature controlled storage. It does offer value-add services such as tempering, coding, and building customized kits or priority stacking, which can reduce the burden of the receiving customer in sorting and managing the receipt. It also conducts some transportation business.

From a big picture perspective, I think this is quite an attractive place to invest capital for the following reasons:

- Global Warming – more goods will surely need temperature cold storage, and those that do already might need increased usage of cold storage networks like what Americold offers.

- Trump Administration Policies – import policy changes may create inefficiencies in supply chains, necessitating greater use of Americold’s warehouses.

- Occupancy Slack – Americold isn’t running near capacity, which means that Americold can hopefully take on new business without requiring large expansion capex.

- International Opportunities – undoubtedly, warmer-climate (than North America) regions have augmented needs for cold storage. Americold has but tiny operations south of the Mexico, although none of it in Central America.

Recent Trends and Performance

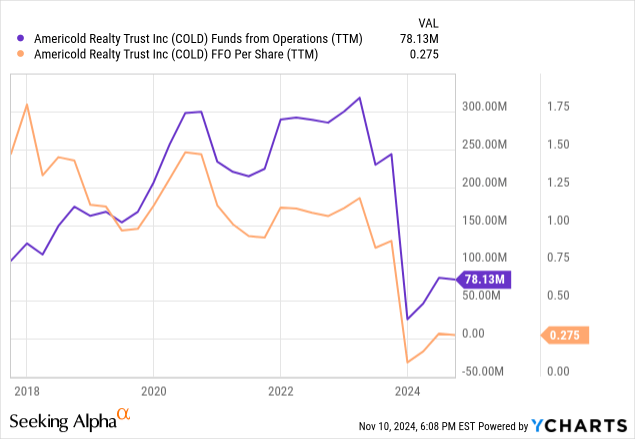

Americold has been struggling for many years. Relatively steady performance and growth up until 2018 has been traded for steep declines in FFO per share, and recently absolute FFO itself.

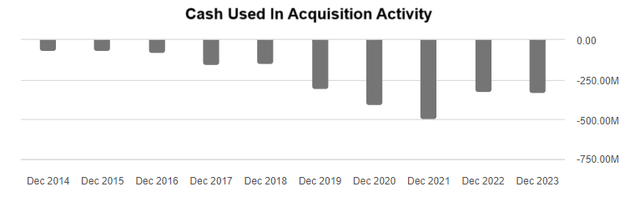

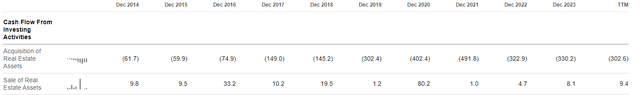

The problems for Americold seem to have initially stemmed from heavy investment in new properties heading into COVID-19 pandemic, and continued property acquisitions through 2021 in anticipation of a post-pandemic surge that didn’t occur to the degree that management expected.

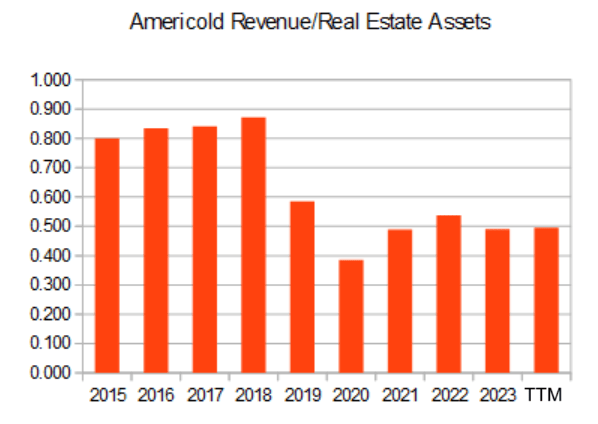

The below chart presenting the amount of revenues Americold has been generating annually as a % of real estate value (essentially the Asset Turnover ratio) is particularly damning.

Americold isn’t anywhere close to generating the same returns on its assets as it was prior to 2019. Further pressuring the per-unit metrics has been an outstanding share count that has nearly doubled in that ~6-year period.

Interest rate increases are never good for a real estate trust, and though Americold has seen their interest expenses rise, the company was recently paying an average rate of below 4%. In its 2023 10-K the company noted that it had USD $645 million and CAD $250 million of variable-rate debt on which it had entered swaps to lock in an average rate in the vicinity of 4.5% While that contributes some peace of mind, at this point the swaps have likely cost Americold and its investors. Meanwhile, the company recently issued $500 million in senior unsecured notes at 5.409%, so it’s pretty safe to suggest that interest costs will be rising in the near future, against an underperforming portfolio of assets.

During the first week of November the company reported a Q3 FFO of $0.29 (AFFO of $0.35) per unit, and although that appeared to be in-line with analyst estimates, the market price of COLD stock has fallen about 13% in the past 3 sessions.

Forward Outlook and Management Comments

In its recent quarterly conference call, Americold management spoke of operational achievements in the face of a struggling end consumer. Such comments are curious against an overall picture of strong consumer spending in the United States, although it’s true that the food industry has been experiencing a different story, given average citizens strained by inflation. Americold, of course, benefits from the volume of business and not so much the price of the goods that it handles. I expect that, over time, food consumers will reach an acceptance of the new normalization – prices aren’t likely to decline back to where they were at the beginning of the decade, but further increases should be more moderate unless Trump Administration policies stoke a new round of inflation.

Nonetheless, despite reiterating AFFO guidance of $1.44 to $1.50 per unit, management conceded that 2024 full-year economic occupancy is expected to be 425 bps to 525 bps lower than in 2023. That will mostly be offset by increased pricing of approximately the same range.

One of the things that likely concerned investors last week is that, despite seeing economic occupancy dip to 77% during the recent quarter, Americold is steadfast in new investment. Specifically, the company is developing a $148 million expansion in the Dallas-Fort Worth area to capitalize on new automation capabilities (Americold has spoken about opportunities that AI will provide its business). Reading between the lines here, it seems more and more likely that new business will bypass some of the unused capacity that the company already has in place. That seems like an indictment of the company’s previous asset acquisitions.

One of the things that, I think, would offer a boost to COLD’s market price is if the company disposed of some of the excess capacity that it has accumulated. Unfortunately, this is a firm that has sparingly disposed of assets, and the extra capacity is surely a meaningful drag.

Perhaps Americold is not in a position right now to shed assets, but they may be in the future, such as when the new Dallas – Fort Worth expansion comes online. My research suggests that the company has 6 existing facilities between these two cities.

Market Price Outlook

I wish Americold management were more concessionary in some of the strategic and operational mistakes that have hurt results and led a $40 unit price to drop below $25 in the past few years.

With that said, I don’t expect the inefficiencies to last indefinitely. The Trust has a unique slate of assets, and there should be value here. I like the long-term prospects for the cold storage industry. It’s unfortunate that insiders own a paltry ~0.15% of COLD units, but any further belly flops might lead to an ouster of this team. It’s notable that this is a pretty fresh executive team, with CEO George Chappelle having joined Americold in 2022, while EVP and CFO Jay Wells was appointed in January 2024 along with Americas President Robert Chambers (who had 4 prior years on the leadership team).

COLD pays a quarterly distribution of $0.22, which translates to a yield of about 3.9%. Despite mediocre operating results, operating cashflows have generally remained healthy enough to support this rate. I don’t see risk to the distribution here.

While COLD units have historically traded well above a 20x P/AFFO multiple, until there are signs of improved operational efficiencies (or new leadership), I’d only be comfortable assigning a flat 20x multiple on the lower end of the AFFO range ($1.44), for a fair value of $28.80.

I’m happy taking a full position of COLD into my portfolio below $23, and collecting a ~4% yield while I wait for the organization to sort out its problems.